July brought continued gains for U.S. stocks, driven by strong corporate earnings and easing trade tensions. While international markets and bonds showed mixed results, economic data remained solid. With broad-based earnings growth and a healthy economic backdrop, investors entered August with cautious optimism despite ongoing geopolitical and policy uncertainties.

Quick Hits

- Beyond the Headlines: Stocks Continued to Climb in July

- Trade Progress Helped Support Markets

- Economic Data Remains Strong

- Risks Still on the Radar

Beyond the Headlines: Stocks Continued to Climb in July

The stock market kept rising in July, thanks to strong company earnings and growing optimism around global

trade. The S&P 500 gained 2.24 percent, the Dow Jones Industrial Average was up 0.16 percent, and the Nasdaq

Composite led the way with a 3.72 percent increase. These solid results pushed both the S&P 500 and Nasdaq to new all-time highs.

(such as those in Europe and Japan) fell slightly. However, stocks in emerging markets (such as Brazil and India) rose for the third month in a row. The MSCI EAFE Index lost 1.4 percent in July while the MSCI Emerging Market Index was up 2.02 percent.

Bond Market: A Mixed Picture

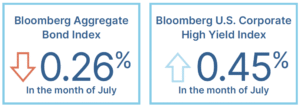

Returns in the bond market were also mixed. Long-term interest rates went up, which tends to push bond prices down. As a result, the Bloomberg Aggregate Bond Index lost 0.26 percent in July. On the other hand, high-yield bonds (which are riskier but offer higher returns) ended the month with gains. The Bloomberg U.S. Corporate High Yield Index gained 0.45 percent for the month.

Trade Progress Helped Support Markets

Just like in recent months, progress on trade negotiations helped keep markets steady. In July, early outlines of trade deals with the European Union and Japan were announced. While we’re still waiting on the full details, these developments were seen as positive signs by investors.

Economic Data Remains Strong

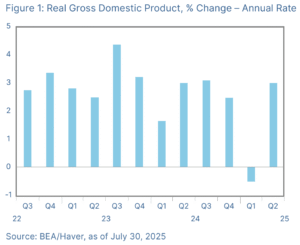

The economic reports released in July were also mostly positive. The first estimate of economic growth (GDP) for the second quarter showed the economy growing at a 3 percent annual rate—stronger than expected and a sign of a healthy economy. As seen in Figure 1, this result represents a return to growth following a modest contraction in the first quarter.

Risks Still on the Radar

Despite the strong earnings and solid economic data, there are still risks that investors should keep an eye on. Geopolitical conflicts remain a concern. While these issues have made headlines, they haven’t had a major impact on markets so far.

There’s also still a lot of uncertainty around government policy from Washington. Even though progress was made on trade in July, unexpected political developments could still create challenges for the market in the months ahead.

All in all, things are looking pretty good as we head into August. Company fundamentals are strong, and the economy is in good shape. While it’s important to stay aware of potential risks, the long-term outlook remains positive, with expectations for continued growth and rising markets. If concerns remain, you should speak with your financial advisor to go over your financial plans.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1 /BB+/BB+ or below. One basis point (bp) is equal to 1/100th of 1 percent, or 0.01 percent.

Authored by Chris Fasciano, chief market strategist, and Sam Millette, director, fixed income, at Commonwealth Financial Network®.

©2025 Commonwealth Financial Network®